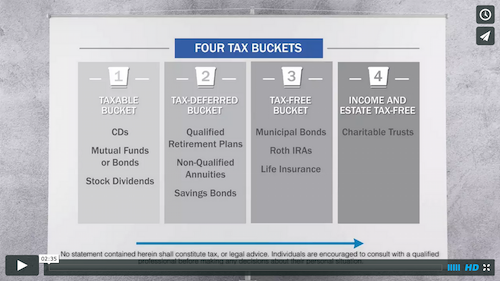

If you’re considering tax planning to make the most of your asset allocations, you need to have a good understanding of how your assets are related to taxes. A good way to gain a basic understanding is by considering the concept of four tax buckets.

The first bucket is your taxable bucket, so any accounts or financial vehicles that you pay tax on each year, whether or not you pull the money out, falls in this bucket. So what does that mean? It might be bank accounts like CDs. It might be brokerage accounts, your mutual funds or bonds or even stock dividends. Anything that gives you a 1099 each year, even though you didn’t pull the money out – maybe you’re just reinvesting – that falls in this taxable bucket.

The second bucket is your tax-deferred bucket. Generally speaking, there are three primary vehicles that fall in the tax-deferred bucket: qualified retirement plans – that’s your 401k’s, 403b’s, 457s, IRAs. Non-qualified annuities also fall in this bucket, as well as savings bonds. Those are all tax-deferred, so those are in that bucket.

The third bucket is your tax-free bucket. There are three financial vehicles that are currently tax-free: municipal bonds, Roth IRAs and properly structured life insurance – notice I said properly structured life insurance.

Nothing else is tax-free. In fact, municipal bonds are not always tax-free, but for the most part they are.

Finally, the fourth bucket is income and estate tax-free, and that’s where you get into charitable trusts and other similar arrangements.

Here’s what you need to know. If you want to reduce taxes on your assets over time, you need to move assets to the right. A common mistake many people make if their objective is to reduce their tax liability is often right here. They have a majority of their assets in qualified retirement plans. This has the potential to create significant tax liabilities down the road. You may want to consider reallocating some assets to the right to help reduce the tax liability over time.

That is the concept of the four tax buckets.

No statement contained herein shall constitute tax, or legal advice. Individuals are encouraged to consult with a qualified professional before making any decisions about their personal situation.