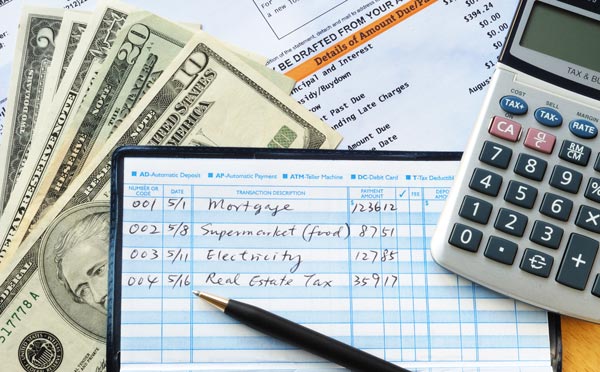

Something most rags-to riches stories have in common is that a good budget is always needed to help anyone achieve financial security. If you want to significantly improve your credit, you have to learn how to pace your spending and increase your savings. No matter how much money you have, there will always be something you can spend it all on and become dead broke again.

Tips for Avoiding an Out of Money Experience

Do you run out of money before you run out of month? Many do, but it doesn’t have to be that way! Wealth is the result of widening the gap between what you earn and what you spend. Most of us make the mistake of ramping up our spending as our disposable incomes rise. This is self-defeating. If you do not develop a respect for money, it will always elude you.

Travel Tips and Tricks For Women Over 50

The idea of traveling has changed for today’s woman over 50.

While older generations considered it to be something reserved only for the very affluent, today’s woman considers it to be a necessity to their well-being.

Although there may have been certain locations that were considered to be “retirement destinations”, today’s women don’t put boundaries on where they can go or what they can do.

Women in their 50s today have completely changed the look of travel.

Today new destinations are pencilled in, from all-inclusive resorts to going it alone while backpacking through Europe.

Traveling for Baby Boomers is becoming such a priority that travel numbers for this group have been on the rise for the past several years. Yes, even amid a downturn in the economy.

If it’s time for you to get up and go out on your own, with a group of gal pals, or with your significant other, keep reading.

You’ll find out where to go and how to get the best deal when going there.

Where to go?

So time is cleared on your schedule and you’re all set to get up and go somewhere. Anywhere that gets you away from it all and puts you in a place you can truly relax.

But where is that exactly? How do you even begin to get ideas of places that would make for an unforgettable getaway?

Start with these top five ideas, provided by Carol and David Porter, creators of the online travel magazine, The Roaming Boomers.

Alaskan cruises – These trips have been popular for at least the past ten years and they’ll continue to be for many more. No matter how many visitors these parts see, their pristine beauty is still as untouched and breathtaking for each new traveler that visits. Alaskan cruises are also the perfect trip whether you’re going solo or you’ve already got a group you’re bringing along. Groups will find plenty to do, while traveling alone will give you the opportunity to meet new people.

Road trips along the Big Sur – Want to take charge of when you head out, how far you go, and how many stops you make along the way? Big Sur is an almost desolate stretch of the Santa Lucia Mountains along the central coast of California. Ride along them and you can be dazzled with the one-of-a-kind views while being thrilled by the winding mountain roads.

Arizona – Enough said, Arizona is a great spot for travelers over 50 and you really can’t pick a bad place in Arizona to go. Phoenix, Tucson, Sedona, Tempe, Scottsdale, and Flagstaff are just a few of the choices you’ll have. They’ll all provide for plenty of fun in the sun in one of the most beautiful spots in America.

Santa Barbara – When you want to trade in hiking boots for heels and travel mugs for wine glasses, Santa Barbara, California is the place to go. You can still find beaches and mountains here for the outdoorsy-type, but this destination is mostly known for its world-renowned food and wine.

Hawaii – Like Arizona, you can’t go wrong no matter where you go in Hawaii. However, those in their 50s often want less of the hurried tourist crowd and more of the peaceful, serene beaches and natural wonders. For this reason, of all the Hawaiian Islands, The Big Island is the top spot for Boomers.

No one can be expected to choose their vacation spot after hearing of just a few choices. To review all of your best options, and maybe even open up the door to new places, there are a number of online travel companies that cater specifically to those over the age of 50.

It can make for a great opportunity to grab your friends and head out on a girls’ getaway.

Or take the time for yourself and enjoy a few days of being solo.

If opting to go it alone, there are some important safety factors to take into consideration.

Travel insurance is one of the most important items you need when traveling. Unfortunately, it’s also one of the most often overlooked. Whether you’re on your own or with others, travel insurance is important for people of any age. It’s so important that if you’re over the age of 50, you’re likely eligible for a discount on travel insurance.

In addition to travel insurance, make sure you register yourself as a traveler with the Department of Foreign Affairs, especially if you’re traveling abroad. This might be the only point of contact you have with your country while away.

Leaving your information with the Department of Foreign Affairs will give them a way to contact you while you’re away. This can be invaluable if you need to be informed of any emergencies. They’ll also provide you with safety information on sexual assault in certain countries, and keeping yourself safe from theft.

For women in particular, it’s of utmost importance that when traveling to a different country, you familiarize yourself with local customs and traditions. Some countries have strict rules for a woman’s dress and behavior and it’s important you know what they are.

All-inclusive vacations

When choosing your ultimate getaway location, you’re not only going to consider where you’d like to go, but also where it will be most affordable for you to go.

But just what are the best budget choices out there for travel? Will cruises get you the best bang for your buck, and are all-inclusive vacations really everything they promise to be?

All-inclusive vacations can be great deals, but you need to make sure you know what you’re getting before you sign any contract or deal.

All-inclusive resorts can provide you with all the sports, recreation, and entertainment you could ask for. Plus they’ll give you up to three full meals a day, sometimes even with free cocktails included.

Read the fine print. Find out exactly what will be “included” in the trip because different locales have different definitions. If you’re unsure of exactly what’s included, you could end up paying a lot more than you thought.

Availability can also be a tricky thing to maneuver with all-inclusive deals. Dates are filled quickly so if your heart is set on a particular time, you’ll need to book as early as possible. However, prices tend to get cheaper the closer you get to the date so if you can be flexible, you can save yourself some cash by booking at the last minute.

However, all-inclusive resorts aren’t for everyone.

If you like to hop from town to town, try different restaurants, and be free to go where you want when you want, you might want to look at a different vacation option.

Cruises

Cruises are very much like all-inclusive resorts in the way that you’ll book your trip, pay for it, and have nearly everything you need provided for you.

Like all-inclusive resorts, you’ll need to book as early as possible to ensure there’s a spot available for you. But, being flexible and snapping up last minute deals can also be a great way to go on a cruise that fits easily within your budget.

One of the best ways to get a deal when taking a cruise is to speak to a travel agent that specializes in cruises. They’ll be able to direct you to the best prices currently available, and tell you about early booking discounts and credits you can receive onboard.

When booking a cruise, don’t forget about “Wave Season,” which runs January through March.

Traveling at this time of year doesn’t mean that you’ll experience high, rolling waves on your cruise. It’s simply the time of year that the travel industry sees its best sales, and when you’ll likely be able to snap up the best deals.

Traveling when you’re in your 50s can be one of the greatest things you’ll ever do. Whether you choose to take the road less traveled by, or visit some of the top spots for Boomers, take these safety and travel tips with you. They’ll help you get the vacation you want at the price you want.

Age-Based Tips for Making the Most of Your Retirement Savings Plan

No matter what your age, your work-based retirement savings plan can be a key component of your overall financial strategy. Following are some age-based points to consider when determining how to put your plan to work for you.

Just starting out

Just starting your first job? Chances are you face a number of financial challenges. College loans, rent, and car payments all compete for your hard-earned paycheck. Can you even consider contributing to your retirement plan now? Before you answer, think about this: The time ahead of you could be your greatest advantage. Through the power of compounding–or the ability of investment returns to earn returns themselves–time can work for you.

Example: Say at age 20, you begin investing $3,000 each year for retirement. At age 65, you would have invested $135,000. If you assume a 6% average annual rate of return, you would have accumulated $638,231 by that age. However, if you wait until age 45 to invest that $3,000 each year, and earn the same 6% annual average, by age 65 you would have invested $60,000 and accumulated $110,357. By starting earlier, you would have invested $75,000 more but would have accumulated more than half a million dollars more. That’s compounding at work. Even if you can’t afford $3,000 a year right now, remember that even smaller amounts add up through compounding.1

Finally, time offers an additional benefit to young adults: the ability to potentially withstand greater short-term losses in pursuit of long-term gains. You may be able to invest more aggressively than your older colleagues, placing a larger portion of your retirement portfolio in stocks to strive for higher long-term returns.2

1 This chart is a hypothetical illustration and is not an indication of any performance.

Getting married and starting a family

At this life stage, even more obligations compete for your money–mortgages, college savings, higher grocery bills, home repairs, and child care, to name a few. Although it can be tempting to cut your retirement plan contributions to help make ends meet, try to avoid the temptation. Retirement needs to be a high priority throughout your life.

If you plan to take time out of the workforce to raise children, consider temporarily increasing your plan contributions before leaving and after you return to help make up for the lost time and savings.

Also, while you’re still decades away from retirement, you may have time to ride out market swings, so you may still be able to invest relatively aggressively in your plan. Be sure to fully reassess your risk tolerance before making any decisions.2

Reaching your peak earning years

This stage of your career brings both challenges and opportunities. College bills may be invading your mailbox. You may have to take time off unexpectedly to care for yourself or a family member. And those pesky home repairs never seem to go away.

On the other hand, with 20+ years of experience behind you, you could be earning the highest salary of your career. Now may be an ideal time to step up your retirement savings. If you’re age 50 or older, you can contribute up to $24,000 to your plan in 2015, versus a maximum of $18,000 if you’re under age 50. (Some plans impose lower limits.)

Preparing to retire

It’s time to begin thinking about when and how to tap your plan assets. You might also want to adjust your allocation, striving to protect more of what you’ve accumulated while still aiming for a bit of growth.3

A financial professional can become a very important ally at this life stage. Your discussions may address health care and insurance, taxes, living expenses, income-producing investment vehicles, other sources of income, and estate planning.4

You’ll also want to familiarize yourself with required minimum distributions (RMDs). The IRS requires you to begin taking RMDs from your plan by April 1 of the year following the year you reach age 70½, unless you continue working for your employer.5

Other considerations

Throughout your career, you may face other decisions involving your plan. Would Roth or traditional pretax contributions be better for you? Should you consider a loan or hardship withdrawal from your plan, if permitted, in an emergency? When should you alter your asset allocation? Along the way, a financial professional can provide an important third-party view, helping to temper the emotions that may cloud your decisions.

1 This hypothetical example is for illustrative purposes only. Investment returns will fluctuate and cannot be guaranteed.

2 All investing involves risk, including the possible loss of principal, and there can be no assurance that any investment strategy will be successful. Investments offering a higher potential rate of return also involve a higher level of risk.

3 Asset allocation is a method used to help manage investment risk; it does not guarantee a profit or protect against a loss.

4 There is no assurance that working with a financial professional will improve your investment results.

5 Withdrawals from your retirement plan prior to age 59½ (age 55 in the event you separate from service) may be subject to regular income taxes as well as a 10% penalty tax.

Sources:

https://www.usaa.com/inet/pages/advice_retirement_planning_getting_started_main

http://www.bankrate.com/finance/retirement/how-to-manage-money-in-early-retirement-1.aspx

Reviewing Your Finances Mid-Year

You made it through tax season and now you’re looking forward to your summer vacation. But before you go, take some time to review your finances. Mid-year is an ideal time to do so, the demands on your time may be fewer, and the planning opportunities greater, than if you wait until the end of the year.

Think about your priorities

What are your priorities? Here are some questions that may help you identify the financial issues you want to address within the next few months.

Are any life-changing events coming up soon, such as marriage, the birth of a child, retirement, or a career change?

Are any life-changing events coming up soon, such as marriage, the birth of a child, retirement, or a career change?

Will your income or expenses substantially increase or decrease this year?

Will your income or expenses substantially increase or decrease this year?

Have you managed to save as much as you expected this year?

Have you managed to save as much as you expected this year?

Are you comfortable with the amount of debt that you have?

Are you comfortable with the amount of debt that you have?

Are you concerned about the performance of your investment portfolio?

Are you concerned about the performance of your investment portfolio?

Do you have any other specific needs or concerns that you would like to address?

Do you have any other specific needs or concerns that you would like to address?

Take another look at your taxes

Completing a mid-year estimate of your tax liability may reveal tax planning opportunities. You can use last year’s tax return as a basis, then make any anticipated adjustments to your income and deductions for this year.

You’ll want to check your withholding, especially if you owed taxes when you filed your most recent income tax return or you received a large refund. Doing that now, rather than waiting until the end of the year, may help you avoid a big tax bill or having too much of your money tied up with Uncle Sam. If necessary, adjust the amount of federal or state income tax withheld from your paycheck by filing a new Form W-4 with your employer.

You’ll want to check your withholding, especially if you owed taxes when you filed your most recent income tax return or you received a large refund. Doing that now, rather than waiting until the end of the year, may help you avoid a big tax bill or having too much of your money tied up with Uncle Sam. If necessary, adjust the amount of federal or state income tax withheld from your paycheck by filing a new Form W-4 with your employer.

To help avoid missed tax-saving opportunities for the year, one basic thing you can do right now is to set up a system for saving receipts and other tax-related documents. This can be as simple as dedicating a folder in your file cabinet to this year’s tax return so that you can keep track of important paperwork.

Reconsider your retirement plan

If you’re working and you received a pay increase this year, don’t overlook the opportunity to increase your retirement plan contributions by asking your employer to set aside a higher percentage of your salary. In 2015, you may be able to contribute up to $18,000 to your workplace retirement plan ($24,000 if you’re age 50 or older).

If you’re already retired, take another look at your retirement income needs and whether your current investments and distribution strategy will continue to provide enough income.

Image Source: http://www.statista.com/chart/3426/how-confident-are-americans-about-retiremen/

Review your investments

Have you recently reviewed your portfolio to make sure that your asset allocation is still in line with your financial goals, time horizon, and tolerance for risk? Though it’s common to rebalance a portfolio at the end of the year, you may need to rebalance more frequently if the market is volatile.

Note: Asset allocation is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss.

Identify your insurance needs

Do you know exactly how much life and disability insurance coverage you have? Are you familiar with the terms of your homeowners, renters, and auto insurance policies? If not, it’s time to add your insurance policies to your summer reading list. Insurance needs frequently change, and it’s possible that your coverage hasn’t kept pace with your income or family circumstances.

Image Source: http://www.creditdonkey.com/spring-cleaning.html