If you know anything about the market, you should know that the market has both losses and gains. What you might not know is that losses can have more of an impact than gains on the value of your portfolio. Consider this purely hypothetical example. Let’s imagine that you have a portfolio of $100,000, but then you have a 25 percent gain. That’s $25,000. So, the value of your portfolio after one year is $125,000. [

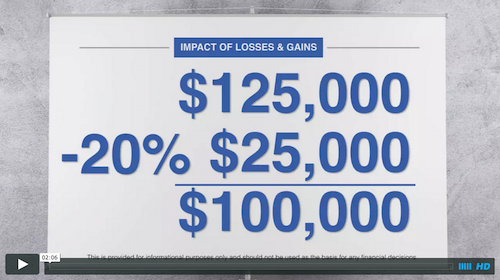

Now let’s say, the next year the market’s down. Let’s say it’s only down 20 percent. Well, what’s 20 percent of $125,000.00? It’s $25,000.

So, now you’re back to $100,000. You were up 25 percent and then your portfolio experienced a 20 percent loss. You weren’t down 25 percent, just 20 percent, but mathematically, it turns out that even though your down year was not as big as your up year, you ended up back to even.

In fact, you could say that your average; a 25 percent gain, minus a 20 percent loss equals 5 percent divided by the 2 years. You’ve averaged plus 2 1/2 percent return, right? You actually averaged a positive rate of return. But, how much did you earn? Nothing. You had a zero actual rate of return. That’s because when it comes to investments, losses can have a more significant impact on the ending result than gains.

If you experience a loss, in this case 20 percent, you need 25 percent just to get back to even. It doesn’t matter in what order the gains and losses occur. A bigger gain is needed to offset a smaller loss.

This is provided for informational purposes only and should not be used as the basis for any financial decisions.