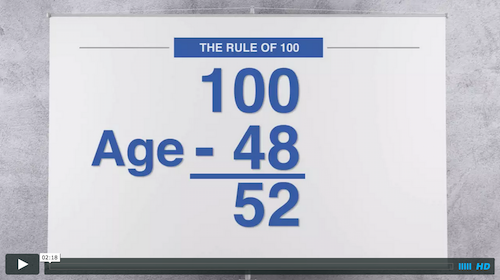

Many people are familiar with the Rule of 100 as a guide for determining general guidelines for a proper balance of your financial assets.

The Rule of 100 works like this: you take your age and subtract it from 100, so 100 minus your age gives you some number. Let’s say you’re 48 years old. If you take 100 minus 48, what do you get? You get 52.

So, how do you use that in your financial strategies? Well, the 52 as a general rule will represent the maximum percentage of your financial assets that you would want to allocate to financial vehicles exposed to any form of market risk. This would typically include stocks, bonds, mutual funds. These products provide the potential for both unlimited upside and unlimited downside.

The portion that represents your age, 48 is the percentage of your assets that you may want to allocate to those financial vehicles generally considered more secure.

And this is the area that sometimes trips people up with regard to the Rule of 100. The concept of balancing your assets between risk and more secure financial products is pretty simple, but sometimes people are unsure which products are considered to be more secure. As a result, they may end up with a poor balance between riskier and more secure products, even though they believe they have adhered to the Rule of 100.

So, here are the financial vehicles that can be considered to offer a level of protection from market losses – CDs, many government-issued securities, fixed annuities and fixed index annuities. What each of these have in common is that you are not subject losses due to market fluctuations.

So, when using the Rule of 100, these are the vehicles you may, with the help of your financial professional, want to consider, to help balance the assets you have allocated to risk.

This is provided for informational purposes only and should not be used as the basis for any financial decisions.