We all know we’re different from men in some fundamental ways. But is this true when it comes to financial planning? In a word, yes. In the financial world, we often find ourselves in very different circumstances than our male counterparts. Everyone wants financial security. Yet we often face financial headwinds that can affect our ability to achieve it. The good news is — now — we have never been in a better position to achieve financial security for ourselves and our families.

Financial Planning for Women: Some key differences

On the path to financial security, it’s important for women to understand what we might be up against. Financially speaking, we have longer life expectancies. Women live an average of 4.8 years longer than men.¹ A longer life expectancy presents several financial challenges for us:

- We will need to stretch our retirement dollars further

- We are more likely to need some type of long-term care, and may have to face some of our health-care needs alone

- Married women are likely to outlive their husbands, which means they could have ultimate responsibility for disposition of the marital estate

Women generally earn less and have fewer savings.

According to the Bureau of Labor Statistics, within most occupational categories, women who work full-time, year-round, earn only 82% (on average) of what men earn.² This wage gap can significantly impact women’s overall savings, Social Security retirement benefits, and pensions. The dilemma is that while women generally earn less than men, they need those dollars to last longer due to a longer life expectancy. With smaller financial cushions, women are more vulnerable to unexpected economic obstacles, such as a job loss, divorce, or single parenthood. And according to U.S. Census Bureau statistics, women are more likely than men to be living in poverty throughout their lives.³

Women are more likely to take career breaks for caregiving.

We are much more likely than men to take time out of our careers to raise children and/or care for aging parents.⁴ Sometimes this is by choice. But by moving in and out of the workforce, we face several significant financial implications:

In addition to stepping out of the workforce more frequently to care for others, we are more likely to try to balance work and family by working part-time, which results in less income, and by requesting flexible work schedules, which can impact our career advancement (and thus the bottom line) if an employer unfairly assumes that our caregiving responsibilities will come at the expense of dedication to our jobs.

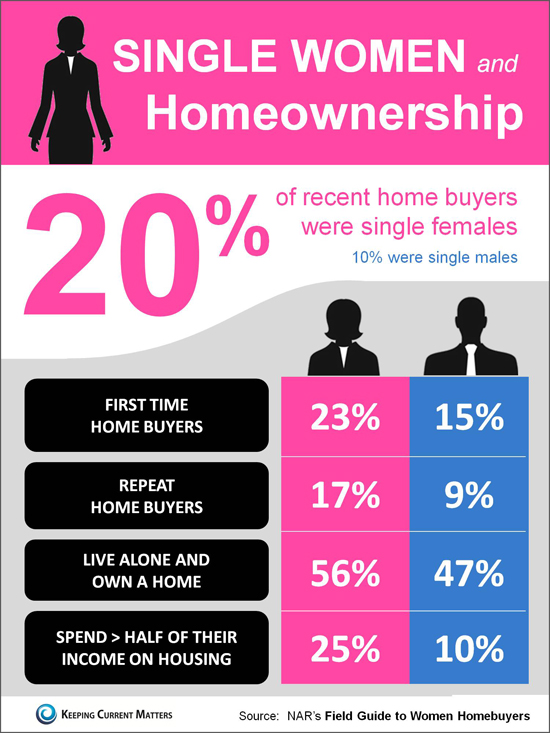

Women are more likely to be living on their own. Whether through choice, divorce, or death of a spouse, more women are living on their own. This means we’ll need to take sole responsibility for protecting our income and making financial decisions.

Women sometimes are more conservative investors. Whether we’re saving for a home, college, retirement, or a trip around the world, we need our money to work hard for us.

Women need to protect their assets. As we women continue to earn money, become the main breadwinners for our families, and run our own businesses, it’s vital that we take steps to protect our assets, both personal and business. Without an asset protection plan, our wealth is vulnerable to taxes, lawsuits, accidents, and other financial risks that are part of everyday life. But we may be too busy handling our day-to-day responsibilities to take the time to implement an appropriate plan.

Steps women can take

In the past, we may have taken a less active role in household financial decision making. But, for many, those days are over. Today, we have more financial responsibility for ourselves and our families. So it’s critical that we know how to save, invest, and plan for the future. Here are some things women can do:

Take control of your money. Create a budget, manage debt and credit wisely, set and prioritize financial goals, and implement a savings and investment strategy to meet those goals.

Become a knowledgeable investor. Learn basic investing concepts, such as asset classes, risk tolerance, time horizon, diversification, inflation, the role of various financial vehicles like 401(k)s and IRAs, and the role of income, growth, and safety investments in a portfolio. Look for investing opportunities in the purchasing decisions you make every day. Have patience, be willing to ask questions, admit mistakes, and seek help when necessary.

Plan for retirement. Save as much as you can for retirement. Estimate how much money you’ll need in retirement, and how much you can expect from your savings, Social Security, and/or an employer pension. Understand how your Social Security benefit amount will change depending on the age you retire, and also how years spent out of the workforce might affect the amount you receive. At retirement, make sure you understand your retirement plan distribution options, and review your portfolio regularly. Also, factor the cost of health care (including long-term care) into your retirement planning, and understand the basic rules of Medicare.

Advocate for yourself in the workplace. Have confidence in your work ability and advocate for your worth in the workplace by researching salary ranges, negotiating your starting salary, seeking highly visible job assignments, networking, and asking for raises and promotions. In addition, keep an eye out for new career opportunities, entrepreneurial ventures, and/or ways to grow your business.

Seek help to balance work and family. If you have children and work outside the home, investigate and negotiate flexible work arrangements that may allow you to keep working, and make sure your spouse is equally invested in household and child-related responsibilities. If you stay at home to care for children, keep your skills up-to-date to the extent possible in case you return to the workforce, and stay involved in household financial decision making. If you’re caring for aging parents, ask adult siblings or family members for help, and seek outside services and support groups that can offer you a respite and help you cope with stress.

Protect your assets. Identify potential risk exposure and implement strategies to reduce that exposure. For example, life and disability insurance is vital to protect your ability to earn an income and/or care for your family in the event of disability or death. In some cases, more sophisticated strategies, such as other legal entities or trusts, may be needed.

Create an estate plan. To ensure that your personal and financial wishes will be carried out in the event of your incapacity or death, consider executing basic estate planning documents, such as a will, trust, durable power of attorney, and health-care proxy.

We are the key to our own financial futures–it’s critical that we educate ourselves about finances and be able to make financial decisions. Yet the world of financial planning isn’t always easy or convenient. In many cases, women can benefit greatly from working with us to help them understand their options and implement plans designed to provide them and their families with financially secure lives.Now more than ever, we have never been in a better position to achieve financial security for ourselves and our families. What financial course will you chart?

¹ The National Vital Statistics Reports, Volume 61, Number 4, May 8, 2013

² U.S. Department of Labor, Bureau of Labor Statistics, Women in the Labor Force: A Databook, December 2012

³ U.S. Census Bureau, Current Population Reports, P60-245, 2013

⁴ U.S. Department of Labor, “Women and Retirement Savings,” October 2011

⁵ U.S. Department of Labor, “Women and Retirement Savings,” October 2011

Broadridge Investor Communication Solutions, Inc. and Parson Latimer & Judge Financial and Insurance Solutions LLC do not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. This communication is strictly intended for individuals residing in the state(s) of CA. No offers may be made or accepted from any resident outside the specific states referenced.

Do you worry about outliving your retirement income? Unfortunately, that’s a realistic concern for us women. At age 65, we can expect to live, on average, an additional 20.3 years.¹

Do you worry about outliving your retirement income? Unfortunately, that’s a realistic concern for us women. At age 65, we can expect to live, on average, an additional 20.3 years.¹  I’m too busy to plan

I’m too busy to plan