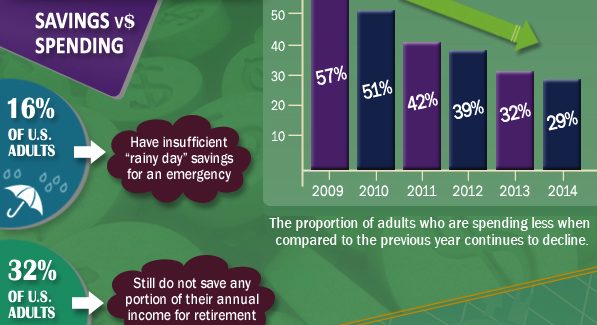

According to a recent survey conducted by Bankrate Financial Security Index, 28 percent of Americans have no emergency savings fund established. An additional 20 percent have not saved enough to cover more than three months of expenses. Perhaps, the biggest problem is that many people do not know how to begin a savings plan. Below is a look at the top five saving tips you should be doing for 2014 that will show you how to build a savings account that can protect your financial future.

-

Track Your Spending

Many women spend more money than they realize, so when it comes to savings they think they do not have any money to spare. Take a closer look at your current finances by tracking your spending for several weeks. Use this information to create a workable household budget that includes a savings category.

-

Make Savings Automatic

If you have direct deposit, contact your bank and have them put a set amount of money out of each paycheck you receive into a separate savings account. This will help you save money without even thinking about it and you will be less likely to spend the money if you do not see it.

-

Start a 401(k) Fund

It is never too early to start thinking about your retirement. If you have a 401(k) plan at your workplace, sign up today to have a set amount go to this account each pay period. Take a look at your budget and determine how much you can afford to put into a retirement fund. Remember, it will add up over time. In addition, if your employer makes a matching contribution, you will be able to save twice as fast.

-

Set Long and Short-Term Goals

No savings plan should be implanted without creating a set of long and short-term goals first. You have to know what your plans are for the money you are saving or you will be more likely to spend it. Setting and achieving these goals will also help you understand the benefit of maintaining a savings plan.

-

Save Your Raise

Before you head off and start spending the extra money you received from your raise, or bonus, this year, consider putting it into your savings account instead.

If you survived this far on your current pay, chances are you can continue on with the same budget.

This way it will not feel like you are putting anymore aside for savings. No matter what habits you choose to start, the most important thing is that you make a commitment to yourself to stick to your plan. It is also vital that you put your savings in a separate account that is not connected to your checking account. This will reduce your impulse to use this money instead of saving it. Also, be sure to track your success and keep account for how much your have saved each month.