You raised them, helped get them through school, and now your children are on their own. Or are they? Even adult children sometimes need financial help. But if your child asks you for a loan, don’t pull out your checkbook until you’ve examined the financial and emotional costs. Start the process by considering a few key questions.

Why does your child need the money?

Lenders ask applicants to clearly state the purpose for the loan, and you should, too. Like any lender, you need to decide whether the loan purpose is reasonable. If your child is a chronic borrower, frequently overspends, or wants to use the money you’re lending to pay past-due bills, watch out. You might be enabling poor financial decision making. On the other hand, if your child is usually responsible and needs the money for a purpose you support, you may feel better about agreeing to the loan.

Source: http://www.pewsocialtrends.org/2013/01/30/the-sandwich-generation/

Will your financial assistance help your child in the long run?

It’s natural to want to help your child, but you also want to avoid jeopardizing your child’s independence. If you step in to help, will your child lean on you the next time, too? And no matter how well-intentioned you are, the flip side of protecting your child from financial struggles is that your child may never get to experience the satisfaction that comes with successfully navigating financial challenges.

Source: http://www.pewsocialtrends.org/2013/01/30/the-sandwich-generation/

Can you really afford it?

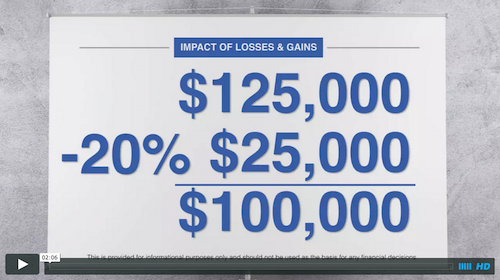

Perhaps you can afford to lend money right now, but look ahead a bit. What will happen if you find yourself in unexpected financial circumstances before the loan is repaid? If you’re loaning a significant sum and you’re close to retirement, will you have the opportunity to make up the amount? If you decide to loan your child money, be sure it’s an amount that you could afford to lose, and don’t take money from your retirement account.

Source: http://www.pewsocialtrends.org/2013/01/30/the-sandwich-generation/

What if something goes wrong?

One potential downside to loaning your child money is the family tension it may cause. When a financial institution loans money to someone, it’s all business, and the repayment terms are clear-cut. When you loan money to a relative, it’s personal, and if expectations aren’t met, both your finances and your relationship with your child may be at risk.

For example, how will you feel if your child treats the debt casually? Even the most responsible child may occasionally forget to make a payment. Will you scrutinize your child’s financial decisions and feel obligated to give advice? Will you be okay with forgiving the loan if your child is unable to pay it back? And how will other family members react? For example, what if your spouse disagrees with your decision? Will other children feel as though you’re playing favorites?

If you decide to say yes

Think like a lender

Take your responsibility, and the borrower’s, seriously. Putting loan terms in writing sounds too businesslike to some parents, but doing so can help set expectations. You can draft a loan contract that spells out the loan amount, the interest rate, and a repayment schedule. To avoid playing the role of parent-turned-debt collector, consider asking your child to set up automatic monthly transfers from his or her financial account to yours.

Pay attention to some rules

Having loan documentation may also be necessary to meet IRS requirements. If you’re lending your child a significant amount, prepare a promissory note that details the loan amount, repayment schedule, collateral, and loan terms, and includes an interest rate that is at least equal to the applicable federal rate set by the IRS. Doing so may help ensure that the IRS doesn’t deem the loan a gift and potentially subject you to gift and estate tax consequences. You or your child may need to meet certain requirements, too, if the loan proceeds will be used for a home down payment or a mortgage. The rules and consequences can be complex, so ask a legal or tax professional for information on your individual circumstances.

If you decide to say no

Consider offering other types of help

Your support matters to your child, even if it doesn’t come in the form of a loan. For example, you might consider making a smaller, no-strings-attached gift to your child that doesn’t have to be repaid, or offer to pay a bill or two for a short period of time.

Don’t feel guilty

If you have serious reservations about making the loan, don’t. Remember, your financial stability is just as important as your child’s, and a healthy relationship is something that money can’t buy.

American Consumer Credit Counseling polled a question at ConsumerCredit.com. In September 2013 they asked:

“Would You Loan Money to Family or Friends in Need?”

They found that the majority of people would, but there were various reasons and various amounts that respondent’s were willing to lend. Check out some interesting stats in the infographic…

Source: http://talkingcents.consumercredit.com/2013/11/14/poll-results-infographic-loaning-money-to-family-and-friends/

Ingredients:

Ingredients: These were made for St Patrick’s Day with goat cheese, spices and a mix of

These were made for St Patrick’s Day with goat cheese, spices and a mix of Ingredients:

Ingredients: These baked wonton cups are an easy, crunchy, and healthy way to serve guacamole!

These baked wonton cups are an easy, crunchy, and healthy way to serve guacamole! These baked wonton cups are an easy, crunchy, and healthy way to serve guacamole!

These baked wonton cups are an easy, crunchy, and healthy way to serve guacamole! This chocolate mint brownie milkshake is the perfect treat for St. Patrick’s Day or any day!

This chocolate mint brownie milkshake is the perfect treat for St. Patrick’s Day or any day! This chocolate mint brownie milkshake is the perfect treat for St. Patrick’s Day or any day!

This chocolate mint brownie milkshake is the perfect treat for St. Patrick’s Day or any day! Easy and creamy avocado feta dip! Serve with cut up veggies, pita chips, chips, bread, or crackers.

Easy and creamy avocado feta dip! Serve with cut up veggies, pita chips, chips, bread, or crackers. This Smashed Chickpea & Avocado Salad Sandwich is a great quick and easy lunch option that is good for you too! The salad also makes a great dip!

This Smashed Chickpea & Avocado Salad Sandwich is a great quick and easy lunch option that is good for you too! The salad also makes a great dip! Crispy, pan-fried gnocchi with basil pesto-an easy meal that tastes good any night of the week!

Crispy, pan-fried gnocchi with basil pesto-an easy meal that tastes good any night of the week! Chocolate cookies with chocolate chips, mint green chips, and chopped up Cool Mint Oreos. These cookies are rich and decadent with a refreshing mint twist.

Chocolate cookies with chocolate chips, mint green chips, and chopped up Cool Mint Oreos. These cookies are rich and decadent with a refreshing mint twist. This healthy Creamy Avocado Yogurt Dip is simple to make and is great for parties or snack time. Serve with pita chips, tortilla chips, or cut up vegetables.

This healthy Creamy Avocado Yogurt Dip is simple to make and is great for parties or snack time. Serve with pita chips, tortilla chips, or cut up vegetables.