To limit borrowing at college time, it’s smart to start saving as soon as possible. But where should you put your money? In the college savings game, you should generally opt for tax-advantaged strategies whenever possible because any money you save on taxes is more money available for your savings fund.

529 plans

A 529 plan is a savings vehicle designed specifically for college that offers federal and state tax benefits if certain conditions are met. Anyone can contribute to a 529 plan, and lifetime contribution limits, which vary by state, are high–typically $300,000 and up.

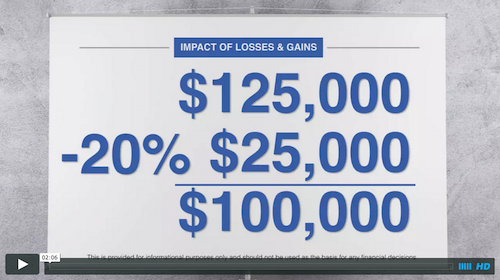

Contributions to a 529 plan accumulate tax deferred at the federal level, and earnings are tax free if they’re used to pay the beneficiary’s qualified education expenses. Many states also offer their own 529 plan tax benefits, such as an income tax deduction for contributions and tax-free earnings. However, if a withdrawal is used for a non-educational expense, the earnings portion is subject to federal income tax and a 10% federal penalty (and possibly state tax).

Contributions to a 529 plan accumulate tax deferred at the federal level, and earnings are tax free if they’re used to pay the beneficiary’s qualified education expenses. Many states also offer their own 529 plan tax benefits, such as an income tax deduction for contributions and tax-free earnings. However, if a withdrawal is used for a non-educational expense, the earnings portion is subject to federal income tax and a 10% federal penalty (and possibly state tax).

529 plans offer a unique savings feature: accelerated gifting. Specifically, a lump-sum gift of up to five times the annual gift tax exclusion ($14,000 in 2015) is allowed in a single year per beneficiary, which means that individuals can make a lump-sum gift of up to $70,000 and married couples can gift up to $140,000. No gift tax will be owed if the gift is treated as having been made in equal installments over a five-year period and no other gifts are made to that beneficiary during the five years. This can be a favorable way for grandparents to contribute to their grandchildren’s education.

Also, starting in 2015, account owners can change the investment option on their existing 529 account funds twice per year (prior to 2015, the rule was once per year).

1 Survey of grandchildren and their grandparents performed by KRC Research on behalf of TIAA-CREF, April 2014.

2 CollegeBoard Trends in College Pricing 2013 http://trends.collegeboard.org

3 U.S. Department of Education, National Center for Education Statistics (2013). Digest of Education Statistics, 2012 http://nces.ed.gov/fastfacts/display.asp?id=76

Image source: https://www.aarpcollegesavings.com/help-your-grandchildren-save-college

Note: Investors should consider the investment objectives, risks, fees, and expenses associated with 529 plans before investing. More information about specific 529 plans is available in each issuer’s official statement, which should be read carefully before investing. Also, before investing, consider whether your state offers a 529 plan that provides residents with favorable state tax benefits. Finally, there is the risk that investments may lose money or not perform well enough to cover college costs as anticipated.

Coverdell education savings accounts

A Coverdell education savings account (ESA) lets you contribute up to $2,000 per year for a child’s college expenses if the child (beneficiary) is under age 18 and your modified adjusted gross income in 2015 is less than $220,000 if married filing jointly and less than $110,000 if a single filer.

Image source: http://lajollamom.com/scholarshare-529-california-college-savings-plans/

The federal tax treatment of a Coverdell account is exactly the same as a 529 plan; contributions accumulate tax deferred and earnings are tax free when used to pay the beneficiary’s qualified education expenses. And if a withdrawal is used for a non-educational expense, the earnings portion of the withdrawal is subject to income tax and a 10% penalty.

The $2,000 annual limit makes Coverdell ESAs less suitable as a way to accumulate significant sums for college, though a Coverdell account might be useful as a supplement to another college savings strategy.

Image source: http://lajollamom.com/scholarshare-529-california-college-savings-plans/

Roth IRAs

Though traditionally used for retirement savings, Roth IRAs are an increasingly favored way for parents to save for college. Contributions can be withdrawn at any time and are always tax free (because contributions to a Roth IRA are made with after-tax dollars). For parents age 59½ and older, a withdrawal of earnings is also tax free if the account has been open for at least five years. For parents younger than 59½, a withdrawal of earnings–typically subject to income tax and a 10% premature distribution penalty tax–is spared the 10% penalty if the withdrawal is used to pay a child’s college expenses.

Roth IRAs offer some flexibility over 529 plans and Coverdell ESAs. First, Roth savers won’t be penalized for using the money for something other than college. Second, federal and college financial aid formulas do not consider the value of Roth IRAs, or any retirement accounts, when determining financial need. On the flip side, using Roth funds for college means you’ll have less available for retirement. To be eligible to contribute up to the annual limit to a Roth IRA, your modified adjusted gross income in 2015 must be less than $183,000 if married filing jointly and less than $116,000 if a single filer (a reduced contribution amount is allowed at incomes slightly above these levels).

And here’s another way to use a Roth IRA: If a student is working and has earned income, he or she can open a Roth IRA. Contributions will be available for college costs if needed, yet the funds won’t be counted against the student for financial aid purposes.

Important Disclosure

Source:

http://cgi.money.cnn.com/tools/collegeplanner/collegeplanner.jsp

http://blog.classesandcareers.com/education/2014/01/08/infographic-saving-for-college-tuition-expenses/

Scenario #1: If you start saving at your child’s birth, you must put away $2,121 per year into a 529 plan, and then other plans once that’s maxed out, in order to have enough for your child to begin college at 18 and finish in four years.

Scenario #2: If you start saving at your child’s sixth birthday, you must put away $3,059 per year into a 529 plan, and then other plans once that’s maxed out, in order to have enough for your child to begin college at 18 and finish in four years.

Scenario #3: If you start saving at your child’s 12th birthday, you must put away $5,101 per year into a 529 plan, and then other plans once that’s maxed out, in order to have enough for your child to begin college at 18 and finish in four years.