5 Saving Tips You Should Be Doing for 2014

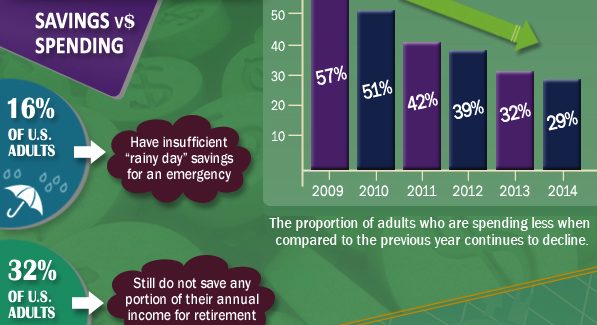

According to a recent survey conducted by Bankrate Financial Security Index, 28 percent of Americans have no emergency savings fund established. An additional 20 percent have not saved enough to cover more than three months of expenses. Perhaps, the biggest problem is that many people do not know how to begin a savings plan. Below is a look at the top five saving tips you should be doing for 2014 that will show you how to build a savings account that can protect your financial future.

-

Track Your Spending

Many women spend more money than they realize, so when it comes to savings they think they do not have any money to spare. Take a closer look at your current finances by tracking your spending for several weeks. Use this information to create a workable household budget that includes a savings category.

-

Make Savings Automatic

If you have direct deposit, contact your bank and have them put a set amount of money out of each paycheck you receive into a separate savings account. This will help you save money without even thinking about it and you will be less likely to spend the money if you do not see it.

-

Start a 401(k) Fund

It is never too early to start thinking about your retirement. If you have a 401(k) plan at your workplace, sign up today to have a set amount go to this account each pay period. Take a look at your budget and determine how much you can afford to put into a retirement fund. Remember, it will add up over time. In addition, if your employer makes a matching contribution, you will be able to save twice as fast.

-

Set Long and Short-Term Goals

No savings plan should be implanted without creating a set of long and short-term goals first. You have to know what your plans are for the money you are saving or you will be more likely to spend it. Setting and achieving these goals will also help you understand the benefit of maintaining a savings plan.

-

Save Your Raise

Before you head off and start spending the extra money you received from your raise, or bonus, this year, consider putting it into your savings account instead.

If you survived this far on your current pay, chances are you can continue on with the same budget.

This way it will not feel like you are putting anymore aside for savings. No matter what habits you choose to start, the most important thing is that you make a commitment to yourself to stick to your plan. It is also vital that you put your savings in a separate account that is not connected to your checking account. This will reduce your impulse to use this money instead of saving it. Also, be sure to track your success and keep account for how much your have saved each month.

Top 5 Financial FAQ for Married Women

As a retirement income planning company for women, we often get financial questions. We’ve written the top 5 FAQ for married women below in hopes that it could be of benefit to you as a woman. If you have a question of your own, feel free to let us know!

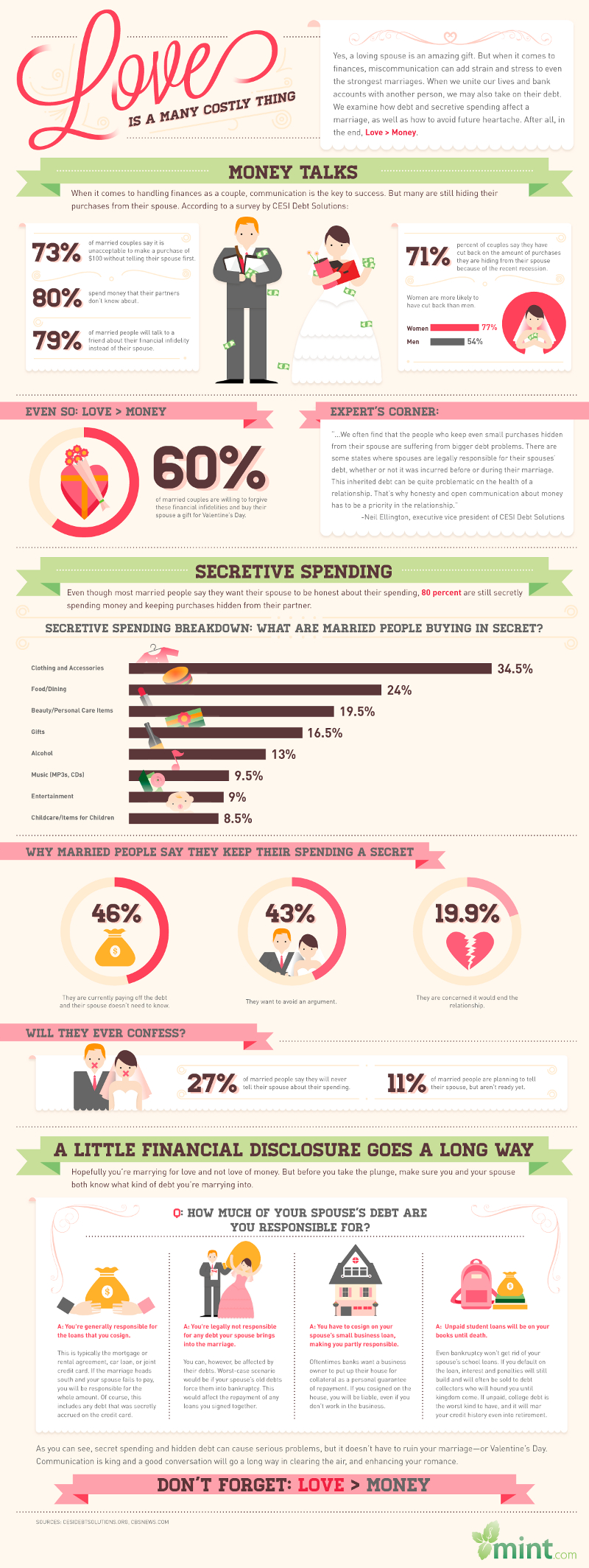

Am I liable for my spouse’s debts?

The general rule is that spouses are not responsible for each other’s debts, but there are exceptions. Many states will hold both spouses responsible for a debt incurred by one spouse if the debt constituted a family expense (e.g., child care or groceries). In addition, community property states will hold one spouse responsible for the other’s debts because both spouses have equal rights to each other’s income. Also, you are both responsible for any debt that you have in both names (e.g., mortgage, home equity loan, credit card).

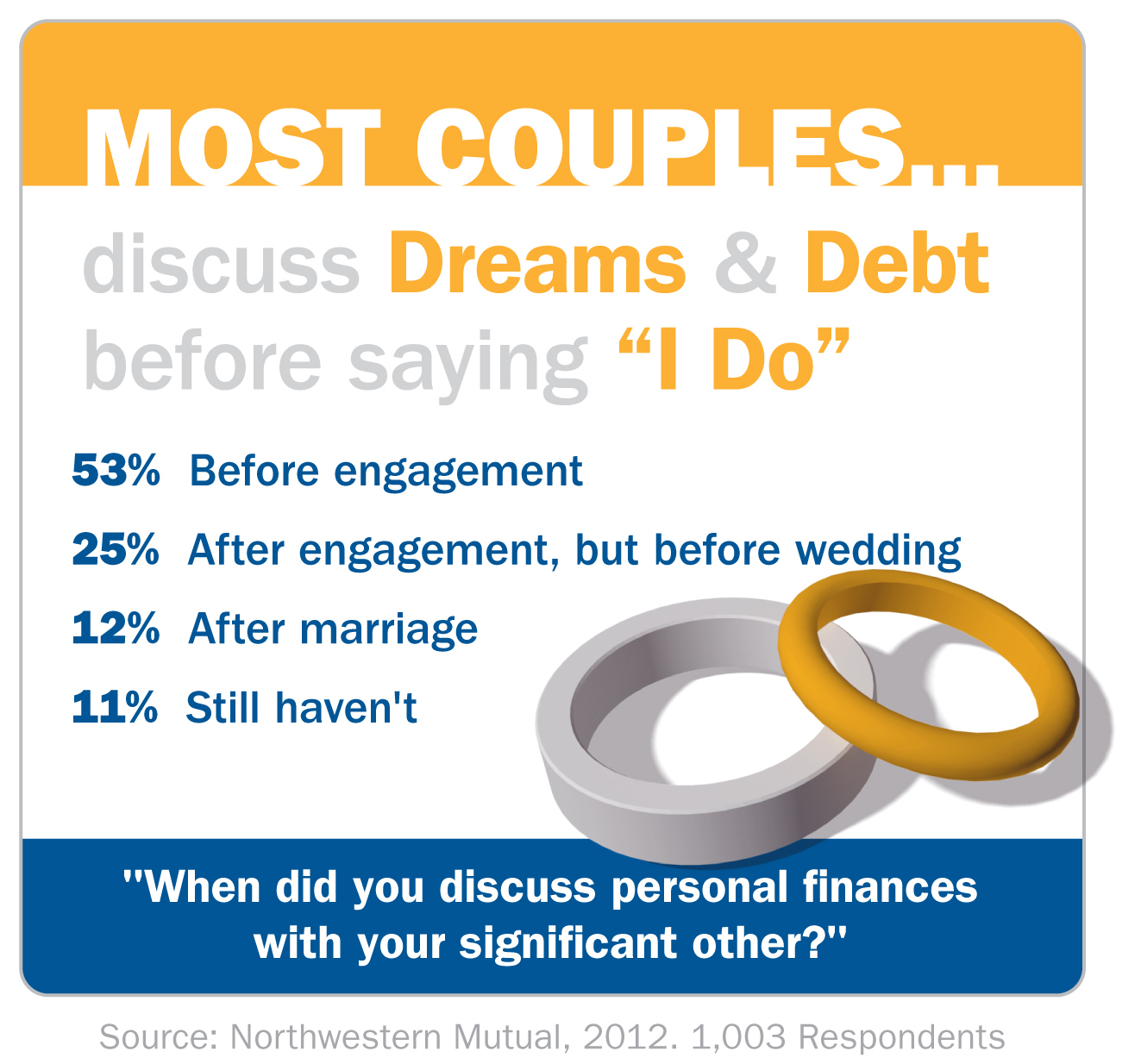

I’m marrying someone with bad credit. How will this affect me?

You are not responsible for your future spouse’s bad credit or debt, unless you choose to take it on by getting a loan together to pay off the debt. However, your future spouse’s credit problems can prevent you from getting credit as a couple after you’re married. Even if you’ve had spotless credit, you may be turned down for credit cards or loans that you apply for together if your spouse has had serious problems.

You’re smart to face this issue now rather than wait until after you’re married to discuss it. Attitudes toward spending money, along with credit and debt problems, often lead to arguments that can strain a marriage. Order copies of both of your credit reports from one or more major credit reporting bureaus. Then, sit down and honestly discuss your past and future finances. Find out why your future spouse got into trouble with credit.

Next, if there is still outstanding debt, consider going through credit counseling together. Credit counseling may help your future spouse clean up his or her credit record and get back on track financially. Finally, seriously consider keeping your credit separate, at least until your spouse’s credit record improves. You don’t have to combine your credit when you marry. For instance, apply for credit by yourself instead of applying for joint credit after you’re married. You can have separate “associate” cards issued for your spouse to use. Even if your spouse has bad credit, your credit rating will remain unaffected. However, keeping separate credit can be complicated. For one thing, your spouse may resent that you control all of the credit in the household. It’s also possible that you’ll have a harder time qualifying for loans (e.g., a mortgage) alone than if your spouse’s income could also be counted.

I’m getting remarried. How will this affect my Social Security benefits?

If you’re receiving benefits based on your own work record, your benefits will continue. If you’re receiving spousal benefits based on your former spouse’s work record, those benefits will generally end upon your getting remarried, but you may be able to receive benefits based on your new spouse’s work record, or on your own.

If you’re a widow(er) under age 60, or you’re disabled but under 50, remarriage ends any benefits based on the record of your deceased spouse. However, if you remarry after age 60 (or after 50 and are disabled), those benefits remain intact, unless you get spousal benefits through your new spouse (at age 62 or older) if those benefits are higher. If your second marriage ends as a result of death, divorce, or annulment in less than 10 years, you will again be eligible to collect benefits on your first spouse’s record. Benefits paid to a disabled widow(er) are unaffected by remarriage.

Note, too, that if you were the working spouse during your first marriage, your remarriage does not change the Social Security benefits paid to either your new spouse or ex-spouse. Because the rules surrounding payment of benefits are complicated, and depend on your particular situation, contact the Social Security Administration for more information.

I don’t know much about investing. Should I let my husband make the decisions?

Even if your husband is a financial expert, it’s a good idea to at least understand investing basics. For one thing, because women on average tend to live longer than men, the odds are extremely high that you could be responsible for making your own financial decisions at some point. If you suddenly had to make all the decisions yourself–and many women have found themselves in that position–you’d benefit from knowing enough to protect yourself from fraud.

Also, even if your spouse is more knowledgeable about finances than you are, understanding enough to consider the pros and cons involved in an individual financial decision can often produce a better outcome; it forces both of you to address questions you might not have considered otherwise. Knowing why a decision was made can help minimize second-guessing on either side later.

If you disagree about a particular investment, remember that though diversification doesn’t guarantee a profit or prevent the possibility of loss, a diversified portfolio should have a place for both conservative and more aggressive investments. There may be ways to accommodate both spouses’ concerns, and a neutral third party with some expertise and a dispassionate view of the situation may be able to help you work through differences.

My spouse and I are filing separate returns. Can we both itemize our deductions? If so, how do we split the deductions?

When spouses file separately, both must use the same method of claiming deductions. That is, either both parties must itemize, or both parties must take the standard deduction. If you choose to itemize, it’s important to know how to divide your deductions.

If your filing status is married filing separately, you typically report on your income tax return only your own income, expenses, credits, and deductions. Therefore, if you paid for a doctor’s appointment out of your separate checking account, you would claim that deduction on your return. Any medical expenses paid out of a joint checking account in which you and your spouse have the same interest are considered to have been paid equally by each of you, unless you can show otherwise. Different rules may apply in community property states.

You should also be aware that the amount of your total itemized deductions will be limited or phased out if your adjusted gross income exceeds certain levels for years after 2012.

Often, married couples have a lower overall tax liability if they choose to file jointly. This is not always the case, however. If you are unsure which filing method results in the lowest tax liability, you should determine your tax liability both ways before filing your return.

For more information, see IRS Publication 17 or consult a tax professional.

Healthcare Costs for Women

It has been a well-known fact that women’s healthcare costs are much higher than their men’s healthcare costs. According to the National Women’s Law Center, women spend one billion dollars more each year on healthcare costs than men do during the same year. Previously, numerous health insurance companies were charging women a higher premium for private insurance coverage. However, the Affordable Care Act (ACA) eliminated this gender-bias practice and forced insurance company to no longer base premiums on gender. But will the new act really have an impact on the out-of-pocket expense that the average woman will have to pay for healthcare?

Why Are Women’s Cost Higher?

These figures for women’s healthcare cost are difficult to refute, but what makes women’s costs so much higher than men? The first thing to consider is that the majority of women have one or more baby during their lifetime and maternity costs are rising every year. In addition, statistics show that women live an average of five years longer than men. This adds up to five more years of healthcare costs, which can be particularly high for the elderly. Women also typically obtain costly preventative care check-ups at a faster rate than men, and will pay a high price for contraceptives during their lifetime. When factoring in the high rate of insurance premiums, the increase in deductible and co-pays, and the number of medical services that are not covered under insurance, it is easy to see that many women are paying an astronomical amount for healthcare costs.

Problem of Un- or Underinsured

Nearly 20 percent of the women in the country currently do not have insurance. The majority of these women go without the medical services they need because they cannot afford the healthcare costs. Even those women on insurance have a hard time paying their portion of the bill. According to a study done by the Kaiser Foundation, one in three women, who have some form of insurance, do not get the medical attention they need due to high healthcare costs. More than 100,000 women every year lose their health insurance coverage due to a divorce. While COBRA will also help these women maintain the same coverage for up to three years, it usually comes with a very high premium. The ACA may help slightly with this problem, but it is likely to still leave a huge gap in the healthcare industry for women.

Costs during Retirement

Even more importantly, there’s also healthcare costs after retirement. While women may qualify for Medicare after retirement, it will typically only pay 60 percent of the healthcare costs. A study done by Employee Benefits Research Institutes reported that a 65 year old woman might pay as much as $200,000 in out-of-pocket healthcare expenses during her retirement. Plan for these additional costs by doing things such as obtaining long-term care insurance well before retirement age.

Female Financial Paradox: Don’t Be Part of the Statistic

In online articles and discussions there’s no shortage of data related to the Female Financial Paradox that states that although women are earning more income, they still tend to have old-school concepts of money that dictate budgeting and penny pinching rather than using money to grow money.

One notable survey asked 10,000 women about their financial lives. The data returned showed that 90% of women say they are the family breadwinners, yet only 76% are the chief financial planner for the family. In fact, 60% feel they have below average understanding about investing and financial planning skills, and due to discomfort less than 50% seek financial advice.

Statistics don’t have to define your life.

Even though the female financial paradox is very real in the lives of most American women, it does not have to be that way. Currently, there is a surge of women who are earning higher degrees. Women lead in degrees earned: 62% earned AAS, 58% earned a Bachelors, 60% have earned a Masters, and 52% earned a Doctorate.

There is no lack of education among women, so why are they struggling with finance? For the most part, even though they are earning higher incomes, they are still earning less than their male peers at a rate of 81% less or .66 per dollar earned. This unfair imbalance in wages makes it more challenging for women to move away from day to day budgeting and move toward longer term financial planning.

Take small steps to avoid being a part of the statistic.

Naturally, the first step is realizing that financial planning is a good thing rather than a necessary evil. Many women who feel they need to tightly manage their income are unwilling to pay to learn how to manage money because they may not be able to see the potential for a return on the cost of learning.

Planning your future is work that is well worth the effort.

It is not as hard to learn about savings and financial planning to make money grow as it would seem. Yes, there is a lot of foreign sounding terminology and the math may be challenging at first, but over a relatively short time you can learn how to manage your money to grow and be there for you when you are ready to make a large purchase, such as a home or car, and it will be there for you when you are ready to enjoy your sunset years.